The smart Trick of Insurance In Toccoa Ga That Nobody is Talking About

Wiki Article

Not known Facts About Automobile Insurance In Toccoa Ga

Table of ContentsNot known Details About Health Insurance In Toccoa Ga More About Automobile Insurance In Toccoa GaThe Best Guide To Health Insurance In Toccoa GaThe Buzz on Health Insurance In Toccoa Ga

A monetary consultant can additionally assist you determine exactly how best to achieve objectives like conserving for your child's college education or paying off your financial obligation. Although financial consultants are not as well-versed in tax obligation law as an accountant could be, they can offer some guidance in the tax obligation planning process.Some economic advisors supply estate planning solutions to their clients. They may be learnt estate preparation, or they may want to function with your estate attorney to answer questions regarding life insurance policy, depends on and what ought to be made with your investments after you pass away. Finally, it is very important for financial consultants to remain up to date with the market, financial conditions and consultatory finest methods.

To market financial investment items, consultants should pass the relevant Financial Industry Regulatory Authority-administered exams such as the SIE or Series 6 examinations to get their qualification. Advisors who desire to sell annuities or various other insurance policy products need to have a state insurance coverage permit in the state in which they prepare to offer them.

Top Guidelines Of Insurance In Toccoa Ga

You employ an expert who bills you 0. Since of the regular fee structure, several consultants will certainly not function with customers that have under $1 million in possessions to be managed.Financiers with smaller profiles could seek an economic expert that bills a per hour charge as opposed to a percent of AUM. Per hour costs for advisors generally run between $200 and $400 an hour. The more complicated your monetary circumstance is, the more time your consultant will certainly have to devote to handling your assets, making it more expensive.

Advisors are competent professionals who can assist you establish a plan for monetary success and implement it. You might also take into consideration reaching out to a consultant if your personal financial conditions have lately come to be extra difficult. This can suggest acquiring a home, getting married, having children or receiving a large inheritance.

More About Commercial Insurance In Toccoa Ga

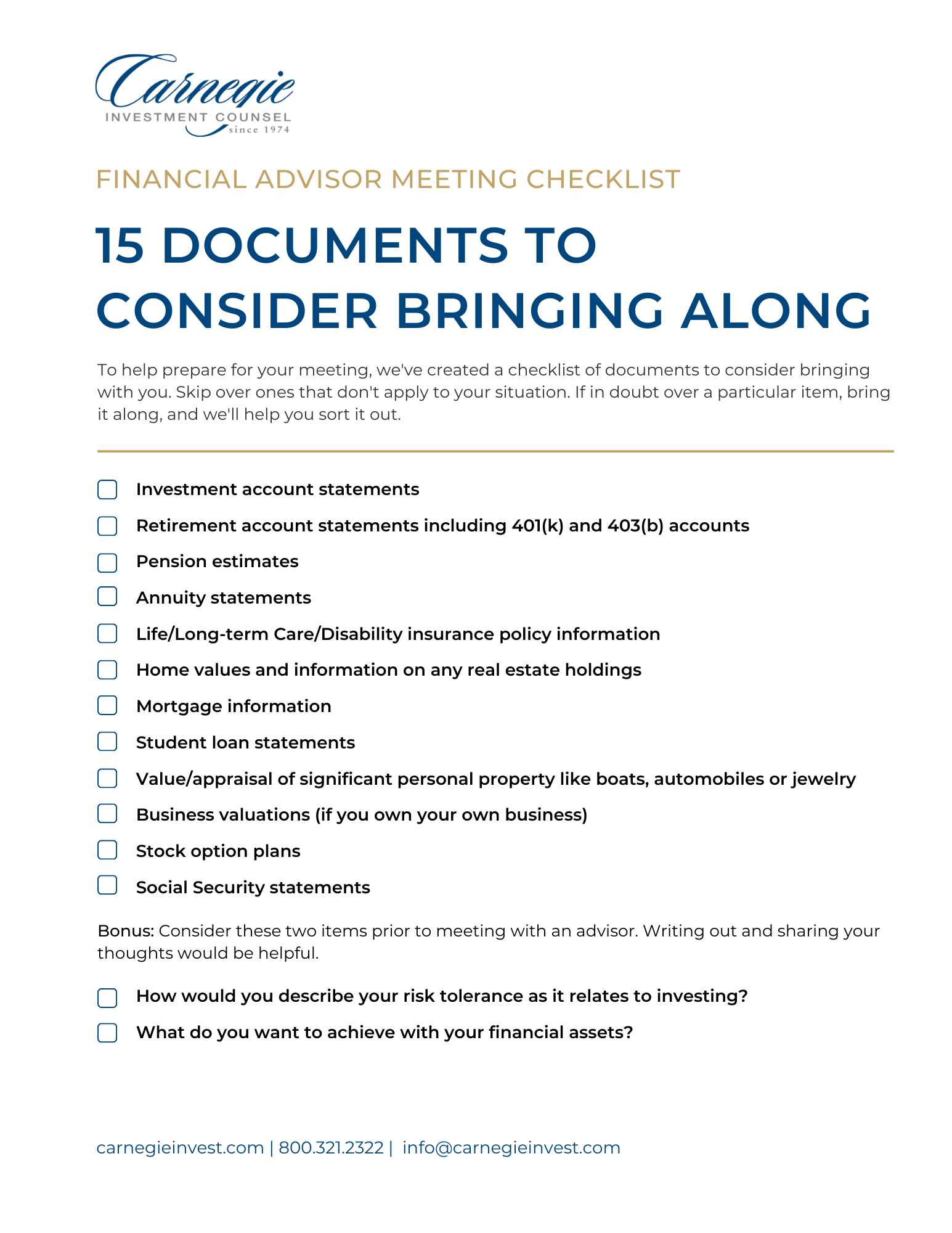

Before you meet with the expert for a preliminary appointment, consider what services are most vital to you. You'll want to seek out a consultant that has experience with the services you want.How much time have you been recommending? What company were you in before you entered into financial suggesting? That comprises your common customer base? Can you supply me with names of a few of your clients so I can review your services with them? Will I be collaborating with you directly or with an associate consultant? You might additionally desire to check out some example monetary plans from the expert.

If all the examples you're given coincide or similar, it may be an indication that this expert does not effectively tailor their recommendations for each and every customer. There are 3 main kinds of economic recommending specialists: Licensed Financial Organizer professionals, Chartered Financial Experts and Personal Financial Specialists - https://www.avitop.com/cs/members/jstinsurance1.aspx. The Qualified Financial Planner professional (CFP professional) accreditation suggests that a consultant has actually satisfied a specialist and moral criterion established by the CFP Board

Our Health Insurance In Toccoa Ga PDFs

When picking an economic consultant, consider somebody with a professional credential like a CFP or CFA - https://community.simplilearn.com/members/jim-thomas_1.5310659/#about. You might also think about a consultant that has experience in the solutions that are essential to youThese experts are normally riddled with conflicts of passion they're extra salespeople than advisors. That's why it's vital that you have an expert who functions just in your ideal passion. If you're searching for an expert who can really give genuine worth to you, it's crucial to research a variety of possible options, not simply choose the given name that promotes to you.

Presently, many experts have to act in your "ideal interest," however what that requires can be almost void, except in one of the most egregious situations. You'll need to find an actual fiduciary. "The very first examination for an excellent economic expert is if they are benefiting you, as your advocate," states Ed Slott, CPA and founder of "That's what a fiduciary is, yet every person says that, so you'll need other indicators than the consultant's say-so or perhaps their qualifications." Slott suggests that consumers look to see whether consultants purchase their recurring education and learning around tax preparation for retirement financial savings such as 401(k) and IRA accounts.

"They should confirm it to you by revealing they have actually taken severe recurring training in retirement tax obligation and estate planning," he says. "You ought to not invest with any advisor who does not spend in their education and learning.

Report this wiki page